Questions? Call (661) 324-2424

We've Helped Businesses Across Kern County find the Insurance Coverage they Need.

Welcome to Fallgatter Rhodes, where we are committed to offering commercial insurance services to Kern County Businesses. We specialize in providing top-notch commercial insurance solutions tailored to the unique needs of businesses. As a business owner, we understand that protecting your assets, employees, and operations is crucial for long-term success. Therefore, we offer insurance services for businesses, offering coverage options that mitigate risks and safeguard your business from potential financial setbacks. Whether you run a small startup or a large corporation, we have the expertise and resources to design custom insurance packages that address your specific industry risks. In addition, our commercial insurance offerings encompass property damage, liability claims, worker injuries, professional errors, and business interruption, among other essential areas. By partnering with us, you can have peace of mind knowing that your business is protected, allowing you to focus on what matters most—growing your enterprise.

Find the insurance coverage you need for peace of mind. We offer a wide range of commercial insurance policies including:

Auto Dealers Insurance

Looking for auto dealers insurance in Bakersfield, CA? Look no further than Fallgatter Rhodes, your trusted insurance provider specializing in tailored coverage for auto dealerships. We understand the unique risks faced by car dealers and are committed to providing top-notch protection for your business. Our team of experienced professionals will work closely with you to assess your specific needs and design a custom insurance package that covers all aspects of your dealership operations, including inventory, liability, property, and more. Trust Fallgatter Rhodes to provide your California auto dealership with reliable, cost-effective, and personalized auto dealers insurance solutions.

Business Liability Insurance

Business liability insurance is a type of insurance coverage designed to protect businesses from financial loss due to liability claims filed against them. Thus, it can provide coverage for legal expenses, settlements, and judgments in cases where a business is held responsible for causing bodily injury or property damage to a third party, or for other liabilities such as personal and advertising injury. Business liability insurance helps safeguard businesses by providing financial protection and allowing them to focus on their operations without the constant worry of potential legal and financial consequences arising from unexpected events or accidents.

Commercial Auto Insurance

If you’re in need of reliable commercial auto insurance for your company work vehicles, look no further. Our range of commercial auto insurance solutions is designed to protect your business vehicles and provide you with peace of mind on the road. Whether you have a small fleet or a large fleet of vehicles, our tailored coverage options can be customized to meet your specific needs. Our expert team of insurance professionals understands the unique risks associated with commercial vehicles and will work closely with you to get you covered. Don’t leave your business exposed to potential liabilities and financial loss—trust us to provide the commercial auto insurance solutions you need to safeguard your operations.

Commercial Property Insurance

Whether you own an office building, retail space, or industrial property in California, our tailored insurance coverage options can be customized to meet your needs. Our experienced team of insurance professionals understands the unique risks associated with commercial properties and will work closely with you to get coverage at competitive rates. Don’t leave your property vulnerable to unforeseen events or disasters—trust Fallgatter Rhodes to provide the commercial property insurance solutions you need to safeguard your investments.

Contractors Insurance

Our range of contractors insurance solutions is designed to protect contractors and their businesses from a variety of risks. For example, whether you’re a general contractor, electrician, plumber, or landscaper, our tailored coverage options can be customized to meet your needs. In addition, we understand the unique challenges faced by contractors and the importance of having insurance protection in place. From liability coverage to equipment and property insurance, we offer solutions that provide financial security and peace of mind. Don’t leave your business exposed to potential liabilities and losses—trust Fallgatter Rhodes to provide the contractors insurance you need.

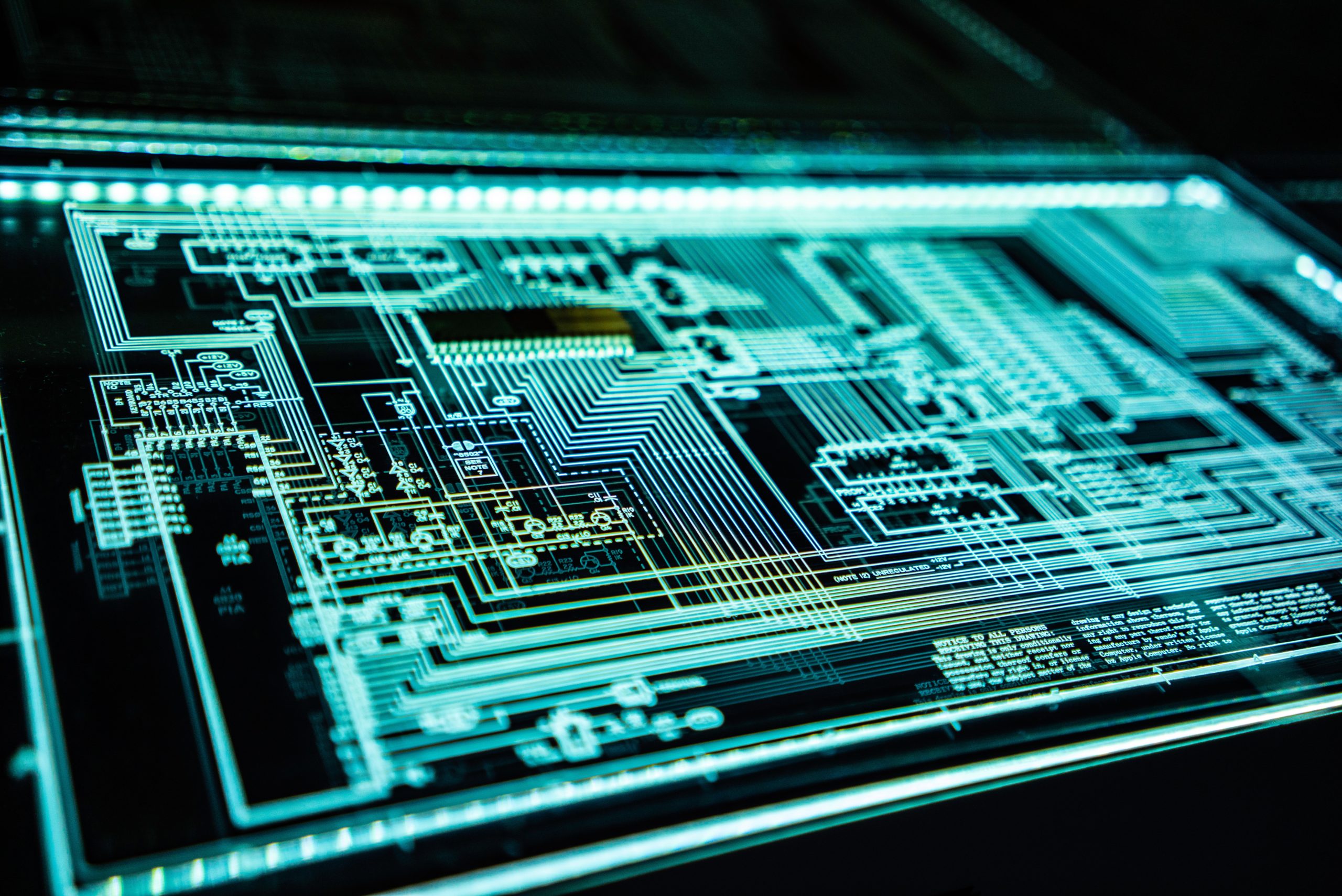

Cyber Liability Insurance

When it comes to protecting your business from cyber risks, Fallgatter Rhodes is here to help with our cyber liability insurance solutions. In today’s digital landscape, businesses are vulnerable to cyber threats, data breaches, and online attacks. Therefore, our tailored coverage options are designed to safeguard your business against the financial and reputational damages that can result from these incidents. Whether you’re a small business or a large corporation, we understand the unique challenges faced in the digital realm and offer specialized coverage to address them. Don’t let cyber threats compromise your operations—contact us today to learn more.

E&O Insurance

Fallgatter Rhodes is your trusted source for reliable Errors and Omissions (E&O) insurance solutions. As a professional, it’s crucial to have protection against claims of negligence, errors, or omissions that may arise from your services. In addition, our tailored E&O insurance coverage is designed to safeguard your business and provide you with peace of mind. Whether you’re a consultant, attorney, accountant, or other professional, our policies can be customized to meet your needs. We understand the unique risks and liabilities associated with professional services, and our experienced team will work closely with you to get coverage. Don’t let a single mistake or allegation jeopardize your professional reputation and financial stability.

Farm & Ranch Insurance

We offer farm and ranch insurance solutions. We understand the unique risks faced by agricultural operations. Whether you own a small family farm or a large commercial ranch, our tailored policies can be customized to meet your requirements. This is why we offer coverage for your dwelling, outbuildings, equipment, livestock, and crops, so that your farm and ranch operations are protected against potential losses. Don’t leave the future of your farm or ranch to chance—trust Fallgatter Rhodes to provide the farm and ranch insurance that offers peace of mind and security.

Group Health Insurance

Fallgatter Rhodes is your trusted partner in providing group health insurance solutions. Moreover, we understand the importance of keeping your employees healthy and productive, and our tailored coverage options are designed to meet the unique needs of businesses of all sizes. In addition, whether you’re a small startup or a large corporation, our experienced team will work closely with you to design a group health insurance plan that fits your budget and provides the coverage your employees deserve. From medical, dental, and vision benefits to prescription drug coverage and wellness programs, we offer a range of options to ensure your employees have access to quality healthcare.

Landlord Liability Insurance

Are you a landlord in California? We understand the unique risks faced by landlords and property owners; therefore, our comprehensive coverage options are designed to protect you from potential liabilities. Whether you own residential or commercial properties, our tailored policies can be customized to meet your needs. From coverage for property damage to protection against lawsuits filed by tenants or third parties, our landlord liability insurance provides the financial security and peace of mind you need. Don’t leave your investment properties vulnerable to unforeseen events—trust Fallgatter Rhodes to provide the landlord liability insurance that safeguards your assets.

Liquor Liability Insurance

Whether you own a bar, restaurant, nightclub, or any establishment that serves alcohol, it’s crucial to protect yourself from potential liquor-related liabilities. Our tailored liquor liability insurance policies are designed to safeguard your business and provide you with peace of mind. From coverage for alcohol-related accidents or injuries to protection against liquor-related lawsuits, our experienced team understands the unique risks associated with the liquor industry. Don’t let a single incident jeopardize your business, contact us today to learn more about liquor liability insurance.

Restaurant Insurance

Own a restaurant? Our restaurant insurance policies are designed to safeguard your establishment from various risks, including property damage, liability claims, equipment breakdown, and more. Whether you own a small café or a large fine dining restaurant, our experienced team will work closely with you to assess your needs and design a policy that fits your budget. From general liability coverage to liquor liability, workers’ compensation, and business interruption insurance, we offer a range of options for your Kern County restaurant.

Workers Compensation Insurance

Need workers comp insurance? We understand the importance of protecting your employees and complying with legal requirements. Therefore, our workers’ compensation coverage is designed to provide financial protection for workplace injuries or illnesses. Whether you have a small team or a large workforce, our tailored policies can be customized to meet your needs. We provide coverage for medical expenses, lost wages, rehabilitation, and more. Don’t compromise on the well-being of your employees—trust Fallgatter Rhodes to provide the workers’ compensation insurance that prioritizes their safety and security. Contact us to learn more.

INSURANCE CARRIERS YOU TRUST

Fallgatter Rhodes Insurance Services takes pride in working with trusted insurance carriers.

Request a Business Insurance Quote Today!

Are you seeking commercial insurance services for your Kern County business? Look no further than Fallgatter Rhodes, your trusted insurance provider specializing in tailored coverage for businesses in the area. We understand the unique risks faced by companies in Kern County and are committed to providing top-notch protection for your operations. Our team of experienced professionals will closely collaborate with you to assess your specific needs and design a custom insurance package that covers all aspects of your business, including liability, property, and more. Trust Fallgatter Rhodes to provide your Kern County business with reliable, cost-effective, and personalized commercial insurance services.

CONTACT US TODAY!

© 2023 All rights reserved.

Disclaimer

Support Policy

Legal